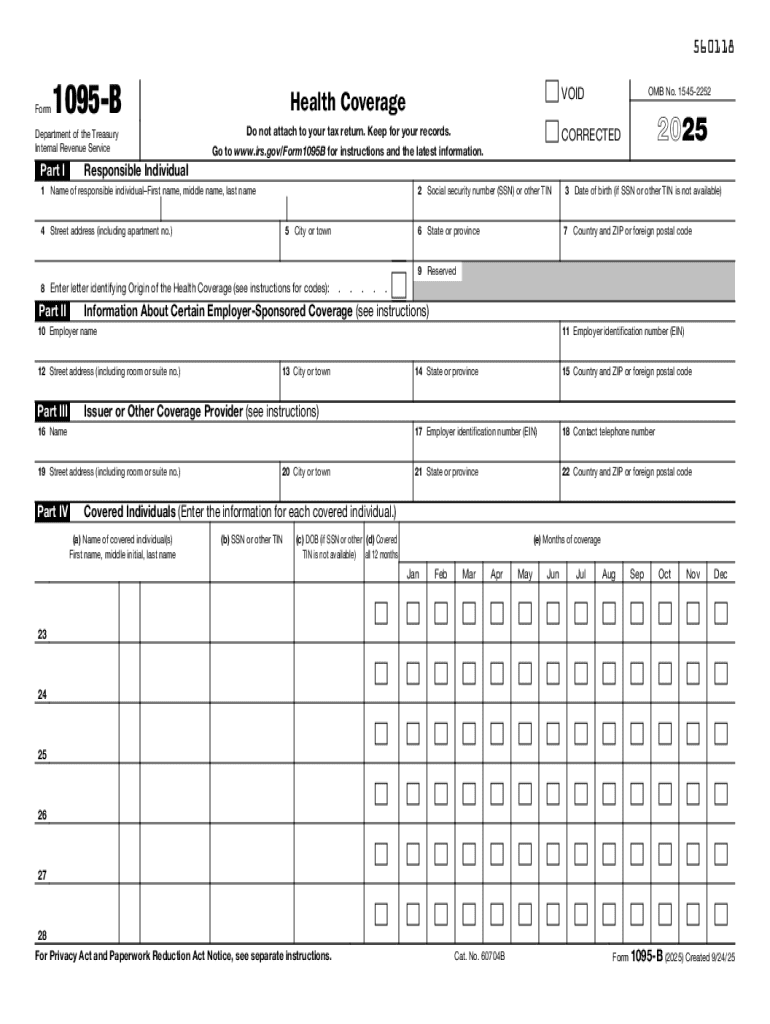

IRS 1095-B 2025-2026 free printable template

Instructions and Help about IRS 1095-B

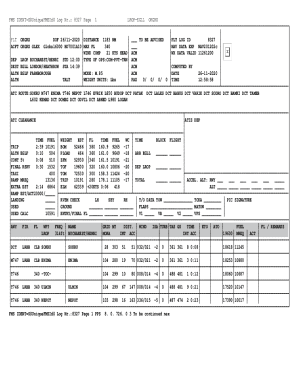

How to edit IRS 1095-B

How to fill out IRS 1095-B

Latest updates to IRS 1095-B

All You Need to Know About IRS 1095-B

What is IRS 1095-B?

When am I exempt from filling out this form?

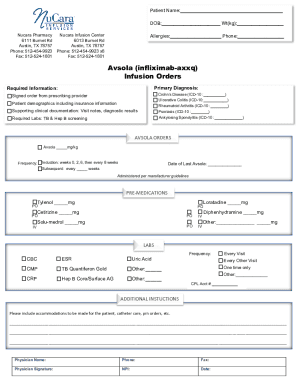

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

Due date

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1095-B

What should I do if I realize I've made a mistake on my IRS 1095-B after filing?

If you've made an error on your IRS 1095-B, the proper course of action is to file a corrected form. You can do this by submitting a new IRS 1095-B with the correct information, marking it as a correction. Make sure to keep records of both the original and corrected forms for your documentation.

How can I check if my IRS 1095-B has been processed?

To verify the status of your IRS 1095-B, you can contact the IRS directly or check your e-filing software if you submitted electronically. Look out for confirmation notices that typically state whether your form was received successfully or if there were any issues during processing.

Are there any specific security concerns I should be aware of when handling IRS 1095-B information?

Ensure that you store your IRS 1095-B securely, as it contains sensitive personal information. It's advisable to use encryption for electronic files and lock away paper copies in a secure location. Familiarize yourself with data privacy standards to protect your and your payees' information from unauthorized access.

What are common errors people make when filing the IRS 1095-B, and how can they avoid them?

Common errors when filing the IRS 1095-B include incorrect taxpayer identification numbers and incomplete information. To avoid these mistakes, review all entries carefully and use a checklist to ensure you're meeting all requirements before submission. Double-checking the details will help prevent rejections and delays.

How does the e-filing process work for the IRS 1095-B, and what technical requirements should I consider?

E-filing your IRS 1095-B is typically straightforward if you use compatible software that meets IRS guidelines. Ensure you have a stable internet connection and check for software updates before filing. It's also advisable to confirm the browser compatibility with your e-filing platform to minimize the risk of technical issues.

See what our users say